Working Capital Loan; A Paradigm for Company’s Growth.

Working Capital Loan; A Paradigm for Company’s Growth.

A company or business required a working capital loan even if your its from a related cash flow issues. possessing an extra capital/cash is paramount should there be an unexpected occurrence. is suffering Working capital loan allows enterprise to consummate their short-term or urgent cash flow shortfalls.

At Havelet Finance Limited, we are poised to help your business grow. We will find the best finance product while you focus on growing your business.

Working Capital Loan Explained

Working capital loan is designed to elevate working capital to sustain a business. This is repeatedly used for a definite growth of a project as securing a sizable contract or an underwriting in the prospective new market.

A lot of businesses uses working capital loan for a diversification of motives. But the general idea is that using working capital finance frees up cash for company growth alongside the business which will be recouped in the short- to medium-term.

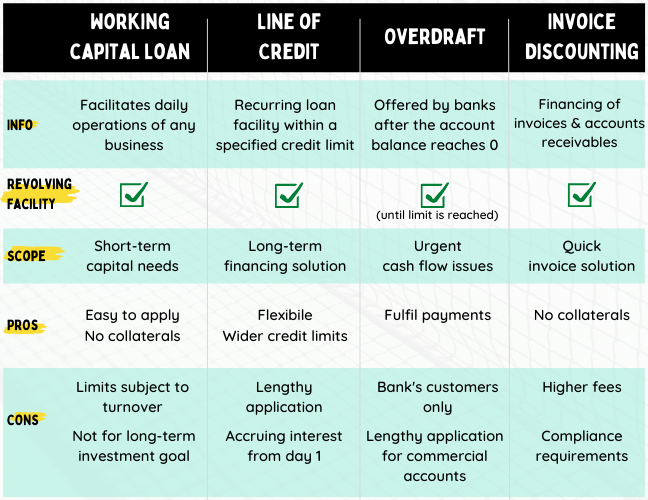

There are viable types of lending that could be considered working capital loan Some are explicitly designed to help working capital (whatever industry you’re in), while others are useful for specific sectors or requirements.

How a Working Capital Loan are Secured

Working capital loan is stash of capital provides to finance a business and/or companies everyday operations. Usually working capital loan is calculated based on cash, assets that can quickly be converted a liquid capital (such as invoices from debtors), and expenses that will be due within a year.

Strategies for a working capital Loan

By observing the major kinds of working capital loan, there is also take sides to different strategies that can make do with the working capital of a business. The most pertinent take side is dependent of the specific occurrences encompassing your business

Below are the three major strategies for working capital loan businesses must recon with based on their sizes, credit score and working capital sales ratio and financial obligations:

Hedge Approach: This necessitates the application of a long-term loan means of using long term account for fixed assets and permanent working capital. Long- and short-term strategies are used to overcome temporary and permanent working capital needs.

Combative Approach: Again, the combative approach required a large scale implementation of short-term loan options. A combative or aggressive approach aims to accelerate your business cycle and reduce idle assets that generate unnecessary costs. in spite of the facts that, there are efficiency merits associated with this approach, it is incredibly high risk compared to a conservative strategy.

Traditional Approach: The name stands out. This is a strategy of finances working capital with low risk and profitability. Working capital loan will primarily be secured through long term solutions in these instances. For example, equity funding, term loans or long-term securities like debentures.

This strategy in addition finances a chunk of your short term working capital. also finances a portion of your temporary working capital. A short term working capital remains the known capital variation and bend the Companies with high cyclical variances such as tourism or farming may adopt this approach.

This methodology helps buffer against insolvency risks.

There is no recorded comprehensive financing solution, it is important that the above approaches are understood prior to approaching a plan for your trades/business.

A business needs to understand its working capital at every stage of the business cycle.

Funding Source for working capital Loan

As soon as you have reached a decision to obtain a working capital loan, the next approach should be where to get funding. There are a lot of financial institution offering working capital loans as we had explained. While looking out for a reliable and genuine for your working capital loan, Havelet Finance Limited is here for you.

Also, traditional banks, and to angel financing schemes and alternative financiers are also institution that offers working capital loan, the options available may be overwhelming.

Unlike FinTech financiers, Havelet Finance Limited are transforming the trade finance industry through their digitized business models. We are aims to improve against convoluted and inaccessible systems by utilising a fully digital, highly intuitive, and easy-to-use platform. The process requires no collateralisation of assets to secure financing.

How to Control A Working Capital Loan

In order to maintain an active drift of working capital, businesses manages an effective directory a pay suppliers on time, pay debts on time, tweak the accounts receivables process and, if needed, consider financing options. There are many types of working capital financing available, and choosing the right product depends on your sector and circumstances, as well as what you’re trying to achieve. To find out more about working capital Loan, Keep in touch with Havelet Finance Limited

Contact us today

Website: https://www.havelet-finance.com

Email: credit@havelet-finance.com

Comments

Post a Comment