Project Financing for Mining & processing Plants.

Project Financing for Mining & processing Plants.

To compete in this new world of lower prices and negative sentiment, companies are closing high-cost mines and restructuring operations in order to streamline their corporate structures. Even as they struggle in the face of this ‘new world order’, companies continue to display a serious appetite for debt and equity financing in their quest to bring new projects into production.

In the hunt for new projects, according to a recently released industry report, spending on non-ferrous mineral exploration surged from $2.1 billion in 1992, to a record $5. 1 billion in 1997. Altogether, this brings the mining industries current annual expenditure on exploration, merger and acquisitions, and capital projects to approximately $60 billion.

Determining the financial requirements of Mining Projects

Within the spheres of gold mining industry, about $3 billion generated per year as profits on existing operations and income from gold hedging. It is also recorded that more than $600 million is raised in shares and another $400 million comes by way of convertibles.

The balance of the capital required to finance a Mining & Processing Plants comes by way of the debt market. The syndicated project loan market is vast and has been used successfully to finance large and risky mining projects in a wide range of countries.

This market is accessible to both mining companies with projects located in developed countries, as well as companies in the LDCs when assisted by the role played by the IFC and, recently, the EBRD.

Investment cost for Mining Projects

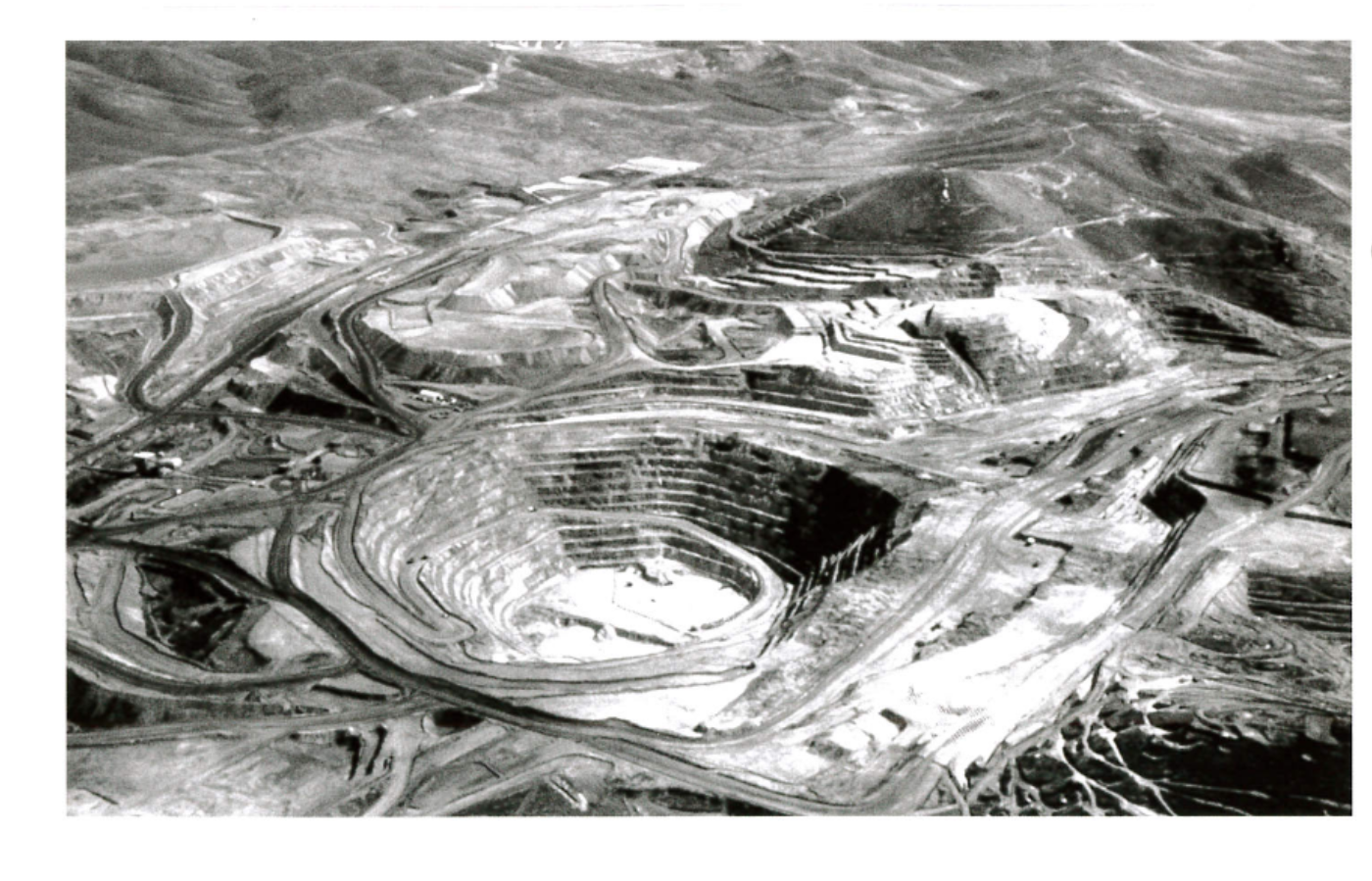

Investment cost for mining projects are almost the same but looking at mining project for gold and iron ore etc, a total consideration should be geared towards project documentation, exploration, geology, archeology of the natural resources and infrastructural developments and environmental protection and many more. In general, the process of construction and commissioning of a mining and processing plant often requires an initial investment in excess of 250–300% of the annual production volume. Of course, specific numbers vary widely and are largely determined by the type of deposit and the method of production, as well as the specific need for equipment for processing mineral raw materials.

Funding Sources for mining and processing plants

Traditional sources include :

- Export credit financing

- Multilateral Institutions

- Commercial bank loans

- Supplier financing & captive finance companies

- Production payment loans and advances

- Debt and commodity-linked securities

- Equity and equity-linked securities

- Internal cash flows

- Joint venture industry partners

There are also some non-traditional sources, such as:

- Host governments

- Leasing companies

- LBO funds

- Individual investors

- Investment management companies

- Institutional investors

Mine financing methods fall within two categories; debt and equity.

Equity Markets

Simply put, equity financing means that investors receive a share in the company in exchange for a cash contribution. It can come from existing shareholders or new issues and is, for the most part, permanent.

Types of Equity Capital Ordinary shares usually form the core of a company’s share capital. The holders carry most of the financial risk in exchange for substantial rewards if the company prospers.

Preferred shares, as the name implies, afford differential treatment to the holder, which might include priority on dividends, voting right and priority in the event the company is liquidated.

Convertibles give right to holders to receive interest and repayment of principal on some specified basis. The holder may exchange the debt into equity of the issuing company, or sometimes a parent company, either over a continuous a period or at intervals during the life of the instruments.

Warrants are usually associated with debt issues and are attached in a similar way to the conversion option found in convertibles. The warrant is effectively the right for the holder to purchase a specific number of shares at a predetermined price on a predetermined date, or between two specified dates in the future.

In this context, mining companies are at an extremely disadvantageous position. Most banks today are wary of new mining projects, reluctant to adjust debt maturities, set grace periods or make other concessions that borrowers need in the face of market uncertainty.

The Balance of Debt and Equity

The appropriate debt to equity ratio for a given project is a matter of negotiation between the sponsor and senior lenders. Many factors are taken into consideration, including customary debt to equity ratios for the particular industry involved, market expectations and risk. The destination of the commodity produced is examined: is it being provided to an assured market, evidenced by an unconditional long-term contract, or is it subject to the uncertainties of general future market conditions?

It is rare for lenders to mining projects to consider debt to equity ratio greater than 70:30, with lenders usually ignoring capital expended by the sponsor prior to the feasibility study in this calculation.

Corporate Versus Project Finance

A mining company looking to carry out an expansion, acquisition or new project development involving a significant capital investment usually seeks some level of debt financing. If recourse financing is used, the lender of the funds has recourse for repayment to the company’s cash flow from all its operations and security over all its assets. The lender’s main concern is then with the total economic health of the company, how the new debt will rank with the total debt, and what future ability the company has to service the total debt. A large mining company might finance a project on its own balance sheet, using corporate debt and equity, but this is not generally an attractive option, despite lower transaction costs.

The corporation is at risk for the total amount of capital it has committed to the development of the project throughout the life of the mine, and the resulting burden on the balance sheet restricts its ability to expand further.

Project Finance

As an alternative to taking projects on their own balance sheet, mining companies have increasingly looked to finance new expansions and acquisitions through project finance. Under these borrowings the capital investment invoked will be repaid only from the cash flows generated by the project. The lenders will not have recourse to the company as a whole. Interest rates are higher than for recourse corporate finance, but higher leverage helps reduce the overall cost of capital.

It is the lender, and not the company, which is exposed to the risk of the cash flows being insufficient to service debt. As a result, companies are anxious to proceed with projects that can be highly leveraged or financed either entirely or substantially on their own merits. In addition, unlike corporate finance, project finance can be considered off-balance sheet debt, thereby allowing a high capital cost project to be developed without having a substantial impact on the mining company’s balance sheet, exceeding corporate debt limits or increasing gearing ratios.

Advantages of Project Finance

It allows a mining company to finance a project beyond (is means while preserving existing banking lines, and to explore competing for investment opportunities. It limits the risks of a project to the company. It also improves the return on capital invested in a project by leveraging the investment to a greater extent. In an extreme case, the sponsor ‘s credit may be so weak, or the project so large, that it is unable to obtain sufficient funds to finance a project at a reasonable east on its own. Project financing may then offer the only practical means available for financing the project.

Disadvantages of Project Financing

Project financing will not lead to lower after-tax cost of capital in all circumstances, as it is complex and costly to arrange. It is structured around a set of contracts that must be negotiated by all involved parties. The necessary legal expenses involved in setting up the project structure, researching and dealing with related tax and legal issues and preparing the necessary project ownership, loan documentation and other related contracts will result in higher transaction costs than conventional financing. Project financing typically also requires a greater investment of management’s time.

Benefits of project finance for mining and processing plants

Project Financing is a long-term, zero or limited recourse financing solution that is available to a borrower against the rights, assets, and interests related to the concerned project.

This type of financing is gaining importance in capital intensive projects in infrastructure, industry, mining and processing of minerals.

Evaluating a Project

Providers of project finance will pay close attention to the discounted cash flow or net present value analysis in their review of the project’s economics. This is the value of the future cash flows of a project in present terms. In the base case, cash flow and sensitivity runs the discounted value of the future cash flows and should always exceed the amount of the debt outstanding. This ratio is known either as a loan life cover ratio (LLCR), based on discounted cash flows to the end of the loan period, or project life cover ratio (PLCR) to the end of the economic life of the project.

The intricacies of Mine and Processing Plant financing are formidable, and can easily be misunderstood. As a consequence, they are often misused. While all mining finance structures share common features, they require tailoring to the particular structure of not only the project, but also the individual sponsor. That is where the challenges are and the rewards lie.

Are you looking for funding for a big projects, Havelet Finance Limited is the one stop for all project financing. Contact US

Website: https://www.havelet-finance.com

Email: credit@havelet-finance.com

Comments

Post a Comment