Trade Finance- Risk, types and Products.

WHAT IS TRADE FINANCE?

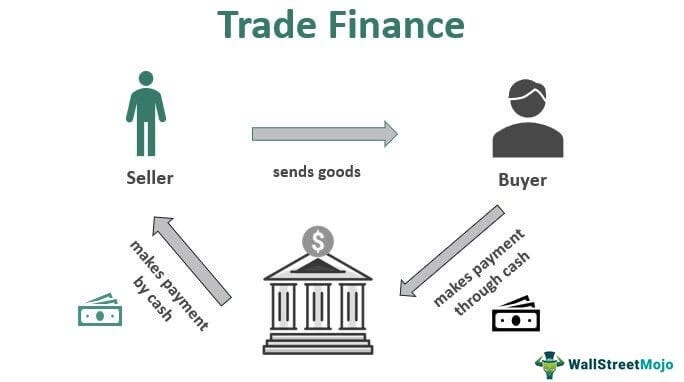

Trade finance is the financing of international trade flows. It exists to mitigate, or reduce, the risks involved in an international trade transaction.

There are two players in a trade transaction: (1)an exporter, who requires payment for their goods or services, and (2)an importer who wants to make sure they are paying for the correct quality and quantity of goods.

WHAT ARE THE RISKS?

As international trade takes place across borders, with companies that are unlikely to be familiar with one another, there are various risks to deal with. These include:

Payment risk: Will the exporter be paid in full and on time? Will the importer get the goods they wanted?

Country risk: A collection of risks associated with doing business with a foreign country, such as exchange rate risk, political risk and sovereign risk. For example, a company may not like exporting goods to certain countries because of the political situation, a deteriorating economy, the lack of legal structures, etc.

Corporate risk: The risks associated with the company (exporter/importer): what is their credit rating? Do they have a history of non-payment?

To reduce these risks, banks — and other financiers — have stepped in to provide trade finance products.

TYPES OF TRADE FINANCE PRODUCTS

The market distinguishes between short-term (with a maturity of normally less than a year) and medium to long-term trade finance products (with tenors of typically five to 20 years).

These are the different types of trade finance products that GTR typically writes about:

Structured trade and commodity finance

Trade credit and political risk insurance

Havelet Finance Limited is trade financing experts. We monetize an expansive range of bank financial instruments effectively and precisely and usually within ten days, and all with a transparency you’ll find refreshing. We have decades of experience monetizing bank instruments. We can monetize owned or leased bank instruments. Our typical turnaround for monetization is 10 days.

If you’re ready to monetize your bank instruments or need direction on how to get a trade finance, click to Request Funding to get started today or continue learning about bank instrument monetization.

Comments

Post a Comment