How Project Finance Could Revolutionize Global healthcare. A Case Study of Africa.

How Project Finance Could Revolutionize Global healthcare. A Case Study of Africa.

IFC in it’s adventure in Africa described healthcare system as most deteriorating and overwhelmingly the worst in the world! The way forward to eradicate such daunting situation is to engage in international project finance for succor within healthcare system.

The countries with the highest rates of maternal death, death under 5 years old, deaths from trauma & injury and deaths from infectious disease are nearly all in Africa.

Why is Healthcare in Africa Poor?

Ultimately, it comes down to resources. Especially as the price of healthcare globally continues to increase. Jon Guber, a Professor of Economics at MIT describes how in 1950, the American government spent 5% of GDP on healthcare. In 2012, it spent almost 20% of GDP on healthcare. By 2075, its projected to be 40%. That means 40 cents out of every $1 generated in America will go to healthcare! Africa makes up 16% of the world population and carries 23% of the global disease burden, yet it accounted for just 1% of total global health expenditures in 2015.

The population of Africa has increased to of 1.3bn people and an economy smaller than California’s (population 40m), this level of poverty magnifies the need for healthcare whilst simultaneously decreasing the capacity to pay for it.

How Project Finance Can innovate Global Healthcare system

What is project finance?

Project financing Project finance (PF) is a form of financing the construction of capital facilities based on debt repayment through cash flows generated by the facility. To this end, the initiators of the project create a legally independent company (Special Purpose Entity or Special Purpose Vehicle), which is responsible for the development of the project and attracts borrowed funds, guaranteeing the return of the debt exclusively by the assets of the project. It is also involves raising funds on a limited recourse or nonrecourse basis to finance an economically separable capital investment project by issuing securities that are designed to be serviced and redeemed exclusively out of cashflow. Project financing is not based on the firms existing credit like conventional direct financing, rather it is based on cash flows from a particular project.

This financing approach has been used to develop transformative projects across Africa such as railways, airports and power stations. But has been underutilized in healthcare because of what I believe to be three main reasons.

1. Firstly, healthcare is not seen as a priority for most Africa politicians. Africans, unlike Americans, don’t not vote on the basis of healthcare. This study from the Atlantic council shows that the top three issues for Nigerian voters were corruption, security and the economy.

This contrasts with places like Britain and America where healthcare is much higher up on a politicians agenda. The politics around funding of the UK NHS and Obamacare vs alternative US healthcare plans are front and center during political campaigns. Healthcare is a make or break election issue in these countries. Finland’s entire government once had to resign over failed healthcare policy.

Two out of the top five issues that mattered most to US voters in the 2020 election were around healthcare as shown in the diagram above. Politicians like to do the things that will win the next election. There is less political will to undertake projects that are not prioritized by the electorate.

2. Secondly, healthcare investing requires specialist knowledge. Much of this knowledge is held by doctors who do not particularly understand or care to understand finance. Whilst bankers who have the finance, do not really care to understand the complexities of healthcare investment. Many countries have recognized how nuanced healthcare investment is and have developed the specialist knowledge to develop and invest in healthcare projects.

At Columbia University, for example, you can spend an entire MBA term learning about just healthcare investment. A deep understanding of healthcare, finance and increasingly technology are required to effectively develop healthcare projects. If as in Africa, there is no one to bridge the gap, deals simply do not get done.

3. Thirdly, fiscal space, many African governments have high levels of debt and therefore feel the need to prioritize spending on the type of projects that can increase economic growth such as power plants, railways, airports and bridges. For example, historically African governments have provided offtake/guarantees for airports, railways, power stations and even factories. Subsidies have been offered for fertilizer, diesel and electricity.

But many African governments still expect millions of the world poorest people to be able to pay out of pocket for healthcare. Even in far wealthier countries like America and the UK most people would be unable to afford quality healthcare if they paid out of pocket. The strong link between healthcare and economic growth is often overlooked. In this article I wrote for Stears Business, I explain how improvements in healthcare lead directly to economic growth.

Why project finance is an ideal tool for the development of healthcare infrastructure

- It doesn’t depend on balance sheet of an existing company, therefore can be used to develop projects quickly

- The children’s hospital in Dublin cost nearly $3bn in capex alone. That level of healthcare infrastructure spend in Africa would be unthinkable. But it is possible to deliver quality healthcare infrastructure at a fraction of that cost. However, even that level of capex cost would be difficult to achieve for many African governments. Spreading payments over time help countries to manage their fiscal space making it possible to do more with less.

- Increases healthcare budget: Healthcare spending in Africa is extremely low. The type of offtake agreements such as minimum patient number guarantees that make these type of infrastructure projects bankable also increase the amount of money available for healthcare to citizens whilst protecting the government off-takers against healthcare inflation.

4. Economies of scale: Large scale healthcare projects provide economies of scale by reducing fragmentation. This provides more efficiency and cheaper costs per patient. It also increases quality. Bulk purchases of equipment and drugs can be made by these large scale healthcare projects further reducing the cost of care. I explain this further in my article on the world’s cheapest hospital.

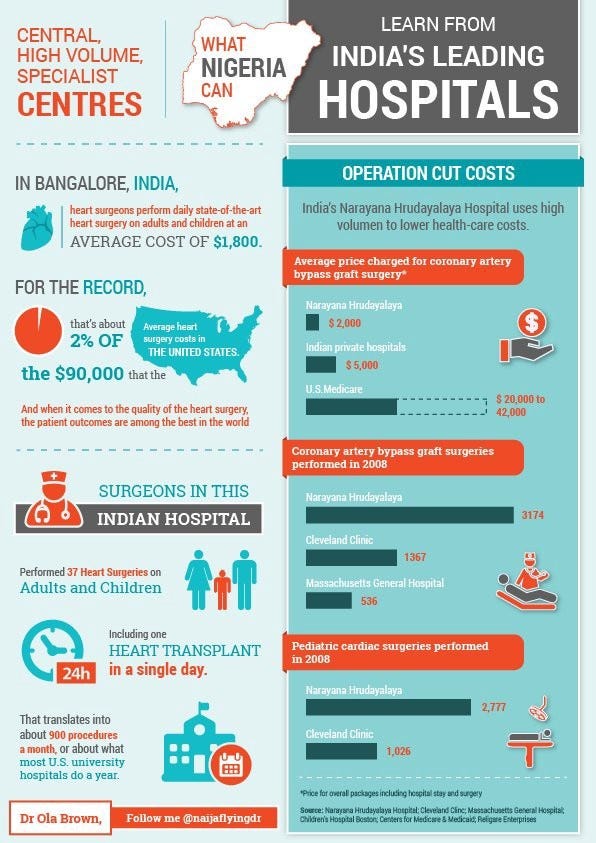

Large scale centralized hospitals in India allow operations to be done at 1- 10% of the prices of American hospitals, but because of the large volumes, the procedures are profitable and clinical outcomes (quality) are the same, sometimes even better,

5. There are other benefits to governments: economic growth and increased productivity. Africa’s health financing gap is at least $66 billion, and business opportunities in the healthcare and wellness sector in Africa are estimated to be worth $259 billion by 2030. This holds the potential to create sixteen million jobs!

Three of the top ten American companies by revenue are healthcare companies. The UK NHS is the second largest employer in the entire world. The biggest sources of employment in almost every American state are in healthcare or education.

In Africa, job creation has the knock on effect on increasing security, reducing illegal migration and helping to fight terrorism. Learn about the massive multiplier effect that healthcare has on the economy by watching our webinar with the Nigerian Ministry for trade and Investment.

Learn more about how Havelet Finance Limited can help you provide financing to section of economy and healthcare.

Comments

Post a Comment