Guide To Working Capital Financing and How to get it

Guide To Working Capital Financing

A working capital Financing is used to finance a company’s everyday operations. These financing are not used to buy long-term assets or investments and are, instead, used to provide the working capital that covers a company’s short-term operational needs. Those needs can include costs such as payroll, rent, and debt payments. In this way, working capital loans are simply corporate debt borrowings that are used by a company to finance its daily operations.

Working capital financing is a common practice for businesses with an inconsistent cash flow. Companies from every industry use working capital financing to expand and scale up. For example, a large business with steady cash flow may apply for a working capital loan to finance the expansion of operations into a new region. In this instance, the loan will act as a buffer until the new region becomes self-sufficient. Similarly, a small business may require working capital finance to bridge the gap between cash inflows and outflows while the business grows.

Importance of Working Capital Finance for Businesses

Whether your business is facing cash flow issues or not, having extra cash in reserves is always good to secure yourself during unexpected circumstances. Working capital financing lets firms fulfil their short-term or urgent cash flow shortfalls.

Benefits of Working Capital Financing

This financing option is beneficial for different business types and purposes. Below are key benefits of working capital financing:

Cover Expenditure Gaps

Working capital financing helps keep a business afloat by financing its payment gaps and fulfilling its working capital requirement. Small and growing businesses solely relying on accounts payables to fuel their working capital can support their everyday operations without the need for an equity transaction.

Zero Collateral Requirement

Firms with good credit ratings are granted unsecured working capital finance. They do not need to forfeit any collateralised assets in the event of default. The ability to access zero collateralised financing enhance the business’s credibility. Unlike most finance institution will not overlook collateral because the loan is merely unsecured, Havelet Finance Limited requires a personal guarantee/promissory note as security of working capital financing. Such must be notarized by a public notary to accord it legal.

Faster and Flexible

Since businesses usually seek working capital financing to meet their immediate cash flow needs, lending institutions need to process it quickly.

Types of Working Capital Finance

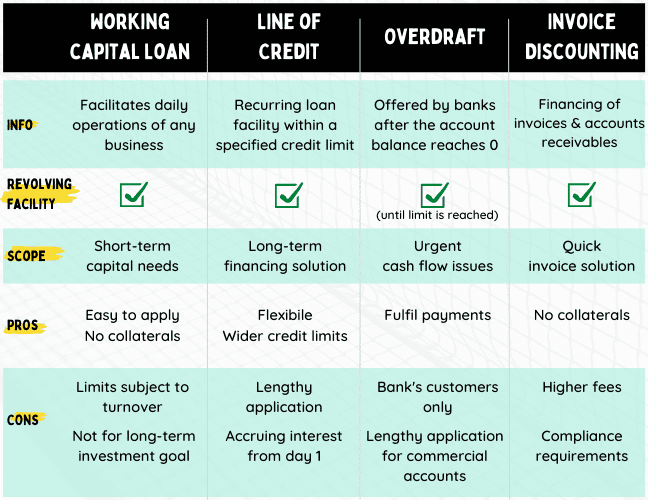

There are several ways of financing working capital. The most common are:

Each have their advantages and disadvantages.

However, some are easier to get approval than others as banks can ask for huge collateral coverage depending on your businesses’ credit status.

Working capital loan

Very simply, a loan taken to finance the daily operations of a business.

For example, a business applies for a loan to cover the rental cost of the premises. Renting a premise would indirectly generate enough yield to pay the loan by maturity.

One of the drawbacks of a working capital loan is that it must be taken out again each time.

For this reason, a working capital loan makes it a poor long term working capital financing solution compared to alternatives.

Hence, not effective for businesses experiencing frequent cash flow shortage.

The size can vary wildly — generally between $2,000 to $5 million.

Working Capital Funding Sources

Once you understand your working capital requirements, you may wonder where to go for financing. Numerous financial institutions are offering the different working capital financing facilities explained above. From more traditional banks and financial institutions to angel financing schemes and alternative financiers, the options available may be overwhelming.

Havelet Finance Limited are international Loan lenders and financier. We are transforming the trade finance industry through their digitized business models.

Havelet Finance Limited aims to improve against convoluted and inaccessible systems by utilizing a fully digital, highly intuitive, and easy-to-use platform. The process requires no collateralization of assets to secure financing.

Havelet finance Limited offers a working capital finance to help businesses maintain a steady cash flow for sustainable business growth. Whether you are an eCommerce, import & export, retail, or supply chain business, we help a wide range of industries meet their working capital financing needs.

For more details on how to secure a working capital loan/financing, contact below;

Website: https://www.havelet-finance.com

Email: credit@havelet-finance.com

Comments

Post a Comment